Commercial Proposal

A consumer proposal is a legal proceeding that allows someone to get out of costly interest rates, pay back a percentage of what they owe and get a fresh start. Mike Wright & Associates will work out an agreement with creditors on your behalf, and the percentage paid, which is interest-free, will depend on your income, on the value of your assets and on the creditors, because they all have different expectations. Once an agreement is in place, you will make monthly payments for no more than five years. The process allows you to avoid bankruptcy, protect assets and make manageable payments. The negotiated settlement comes from the income you make every month after you have paid household bills.

What happens when you file a consumer proposal:

- Mike Wright & Associates will file the proposal with the Office of the Superintendent of Bankruptcy. Once your proposal is filed, you stop making payments directly to your unsecured creditors. In addition, if your creditors are collecting your salary through garnishment of wages or have filed lawsuits against you, these actions are stopped.

- Mike Wright & Associates will submit the proposal to your creditors. The proposal will include a report on your personal situation and the causes of your financial difficulties.

- Creditors have 45 days to either accept or reject the proposal. They can also do this either prior to or at the meeting of creditors, if one is held.

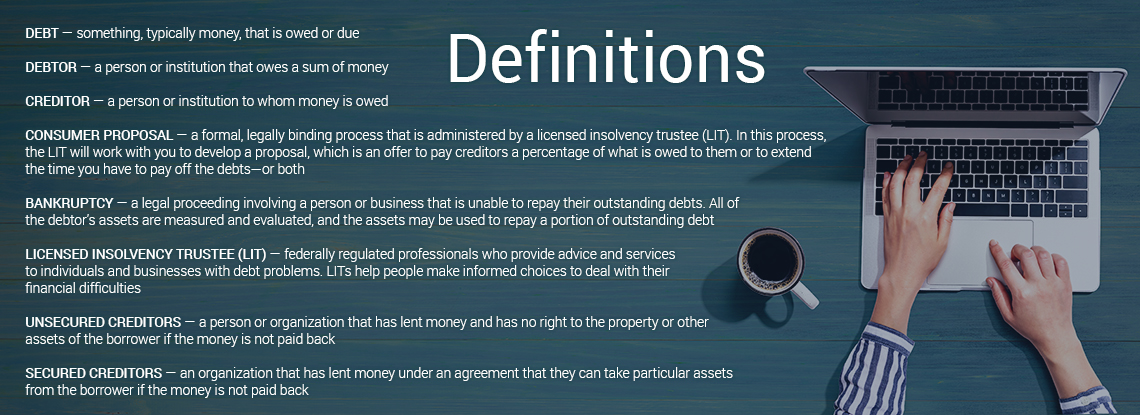

Definitions